How Much Is Property Tax In Guilford County Nc . guilford county (0.92%) has a 26% higher property tax rate than the average of north carolina (0.73%). the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and personal property each year and. Pay your current or delinquent property taxes. for comparison, the median home value in guilford county is $153,800.00. for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. Keep track of your receipts and records. Get help paying your property tax; If you need to find your property's most recent tax. pay guilford county tax bills;

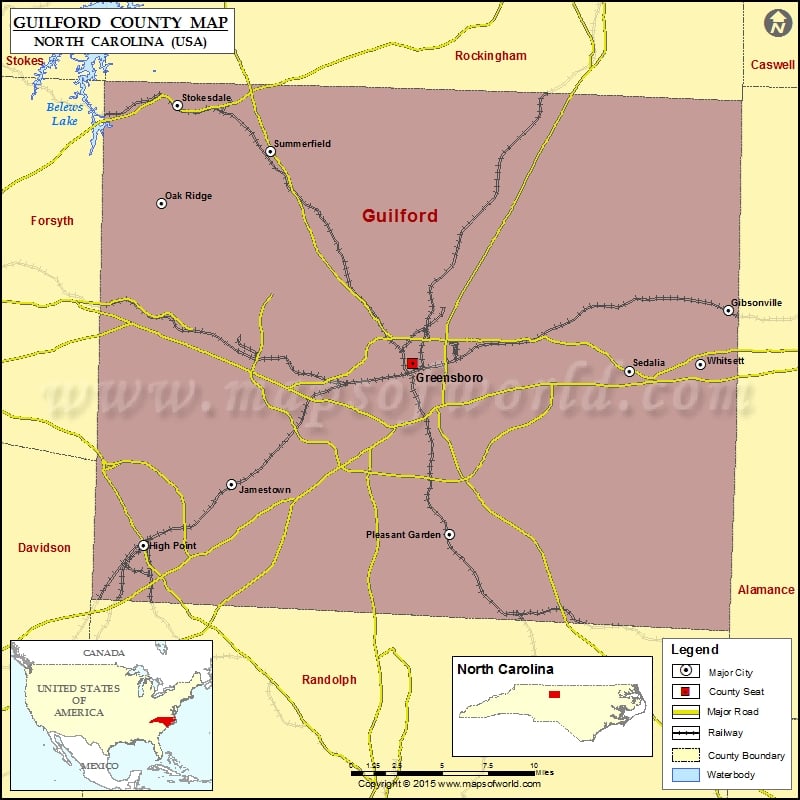

from www.mapsofworld.com

property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. Pay your current or delinquent property taxes. guilford county (0.92%) has a 26% higher property tax rate than the average of north carolina (0.73%). If you need to find your property's most recent tax. for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and personal property each year and. Keep track of your receipts and records. pay guilford county tax bills; for comparison, the median home value in guilford county is $153,800.00. Get help paying your property tax;

Guilford County Map, North Carolina

How Much Is Property Tax In Guilford County Nc Get help paying your property tax; Keep track of your receipts and records. property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. pay guilford county tax bills; Pay your current or delinquent property taxes. guilford county (0.92%) has a 26% higher property tax rate than the average of north carolina (0.73%). Get help paying your property tax; the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and personal property each year and. for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. If you need to find your property's most recent tax. for comparison, the median home value in guilford county is $153,800.00.

From www.land.com

1.42 acres in Guilford County, North Carolina How Much Is Property Tax In Guilford County Nc Pay your current or delinquent property taxes. for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. Keep track of your receipts and records. pay guilford county tax bills; If you need to find your property's most recent tax. Get help paying your property tax; guilford county (0.92%) has. How Much Is Property Tax In Guilford County Nc.

From prorfety.blogspot.com

Guilford County Nc Real Estate Tax Bill Search PRORFETY How Much Is Property Tax In Guilford County Nc Pay your current or delinquent property taxes. Keep track of your receipts and records. for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. If you need to find your property's most recent. How Much Is Property Tax In Guilford County Nc.

From www.land.com

2.33 acres in Guilford County, North Carolina How Much Is Property Tax In Guilford County Nc property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. If you need to find your property's most recent tax. pay guilford county tax bills; Get help paying your property tax; Pay your current or delinquent property taxes. Keep track of your receipts and records. guilford county (0.92%) has a. How Much Is Property Tax In Guilford County Nc.

From www.vrogue.co

Fillable Online Guilford County Zoning Map Lake Livin vrogue.co How Much Is Property Tax In Guilford County Nc Pay your current or delinquent property taxes. pay guilford county tax bills; Keep track of your receipts and records. Get help paying your property tax; the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and personal property each year and. for questions or to provide feedback regarding the information displayed on this. How Much Is Property Tax In Guilford County Nc.

From www.landwatch.com

Gibsonville, Guilford County, NC House for sale Property ID 338681489 How Much Is Property Tax In Guilford County Nc Get help paying your property tax; pay guilford county tax bills; If you need to find your property's most recent tax. Pay your current or delinquent property taxes. Keep track of your receipts and records. the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and personal property each year and. guilford county. How Much Is Property Tax In Guilford County Nc.

From www.neilsberg.com

Guilford County, NC Median Household By Age 2024 Update How Much Is Property Tax In Guilford County Nc for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. Pay your current or delinquent property taxes. property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. pay guilford county tax bills; the tax assessor’s primary responsibility is to appraise, list. How Much Is Property Tax In Guilford County Nc.

From www.landwatch.com

Julian, Guilford County, NC House for sale Property ID 408670154 How Much Is Property Tax In Guilford County Nc Get help paying your property tax; Keep track of your receipts and records. for comparison, the median home value in guilford county is $153,800.00. for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and. How Much Is Property Tax In Guilford County Nc.

From www.youtube.com

Guilford County residents have property tax concerns YouTube How Much Is Property Tax In Guilford County Nc the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and personal property each year and. Get help paying your property tax; guilford county (0.92%) has a 26% higher property tax rate than the average of north carolina (0.73%). Pay your current or delinquent property taxes. If you need to find your property's most. How Much Is Property Tax In Guilford County Nc.

From www.ncgenweb.us

Maps Guilford County, NCGenHow Much Is Property Tax In Guilford County Nc Pay your current or delinquent property taxes. If you need to find your property's most recent tax. property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. Get help paying your property tax; the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and personal property each. How Much Is Property Tax In Guilford County Nc.

From www.wfdd.org

Guilford County Budget Approved, No Increases In Property Taxes 88.5 WFDD How Much Is Property Tax In Guilford County Nc Pay your current or delinquent property taxes. Keep track of your receipts and records. for comparison, the median home value in guilford county is $153,800.00. Get help paying your property tax; guilford county (0.92%) has a 26% higher property tax rate than the average of north carolina (0.73%). pay guilford county tax bills; the tax assessor’s. How Much Is Property Tax In Guilford County Nc.

From www.niche.com

2021 Best Places to Live in Guilford County, NC Niche How Much Is Property Tax In Guilford County Nc pay guilford county tax bills; the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and personal property each year and. for comparison, the median home value in guilford county is $153,800.00. property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. guilford county. How Much Is Property Tax In Guilford County Nc.

From hikinginmap.blogspot.com

Map Of Guilford County Hiking In Map How Much Is Property Tax In Guilford County Nc guilford county (0.92%) has a 26% higher property tax rate than the average of north carolina (0.73%). Keep track of your receipts and records. If you need to find your property's most recent tax. for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. Pay your current or delinquent property. How Much Is Property Tax In Guilford County Nc.

From www.mapsofworld.com

Guilford County Map, North Carolina How Much Is Property Tax In Guilford County Nc property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. pay guilford county tax bills; for comparison, the median home value in guilford county is $153,800.00. the tax assessor’s primary. How Much Is Property Tax In Guilford County Nc.

From www.formsbank.com

Form Av9gc Application For Property Tax Relief County Of Guilford How Much Is Property Tax In Guilford County Nc property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. guilford county (0.92%) has a 26% higher property tax rate than the average of north carolina (0.73%). Keep track of your receipts and records. If you need to find your property's most recent tax. for questions or to provide feedback. How Much Is Property Tax In Guilford County Nc.

From www.mapsales.com

Guilford County, NC Wall Map Premium Style by MarketMAPS MapSales How Much Is Property Tax In Guilford County Nc guilford county (0.92%) has a 26% higher property tax rate than the average of north carolina (0.73%). for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. Get help paying your property tax; Keep track of your receipts and records. pay guilford county tax bills; property taxes make. How Much Is Property Tax In Guilford County Nc.

From www.signnow.com

Guilford County Property Tax Exemption Form Fill Out and Sign How Much Is Property Tax In Guilford County Nc property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. Get help paying your property tax; pay guilford county tax bills; Keep track of your receipts and records. the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and personal property each year and. for. How Much Is Property Tax In Guilford County Nc.

From www.facebook.com

Guilford County Government How Much Is Property Tax In Guilford County Nc If you need to find your property's most recent tax. Keep track of your receipts and records. the tax assessor’s primary responsibility is to appraise, list and assess all taxable real and personal property each year and. for questions or to provide feedback regarding the information displayed on this site, contact the guilford county tax. guilford county. How Much Is Property Tax In Guilford County Nc.

From prorfety.blogspot.com

Guilford County Nc Real Estate Tax Bill Search PRORFETY How Much Is Property Tax In Guilford County Nc property taxes make up about 63% of the revenue to guilford county, followed by sales taxes (13%),. Get help paying your property tax; guilford county (0.92%) has a 26% higher property tax rate than the average of north carolina (0.73%). Pay your current or delinquent property taxes. pay guilford county tax bills; If you need to find. How Much Is Property Tax In Guilford County Nc.